10 steps to survive then thrive post COVID 19

By David Parmenter

For those businesses old enough to remember the 2001-02 (Dotcom bubble burst) and the 2007-08 (loan default crisis) there will be an institutional memory about how important cash was. With the Post COVID 19 recovery, you can ratchet up the importance of cashflow, I believe, by three or four times.

In the previous crises we did not have the worldwide shutdown of international travel as we do now. Its ramifications while obvious to the tourism and travel sectors are less obvious to many peripheral industries. The medium-term impacts have yet to feed through to these entities.

Warren Buffet has many great quotes. This one is very COVID 19 relevant “You only find out who is swimming naked when the tide goes out.” He is making the point that every business leader looks smart during times of economic boom; it’s only when adversity strikes that you see who the real geniuses are.

We are all aware that the tide has well and truly turned. How far it will go out is still up for debate. It could be brutal in the medium term and thus those organisations who are not feeling it yet need to get match ready.

The first thing you need to do is Think, Read, Act in that order

The best thing a leader can do is THINK first.

- What if we asked are staff to form units and their sole purpose was to find ways to pay 80% of their salaries.

- How much fat is there in the high-end salaries? Now is the time to skim the fat off, it was there because the times were good and the highly paid executive were a wanted commodity. Not anymore.

- What other uses could our premises be put to?

- Who are Non-customers? ( a Peter Drucker term )

- How can we start getting back some of that long outstanding debt?

- Can we borrow from our wealthy employees, retired employees?

READ, READ, READ Jack Welch says it so does Warren Buffet.

| Author | Book title / Paper |

| Elizabeth Haas Edersheim on Peter Drucker | “The Definitive Drucker” McGraw-Hill 2006 |

| Jack Welch with Suzy Welch | “Winning” HarperBusiness April 2005 |

| David Parmenter | David Parmenter’s survive and thrive COVID package |

ACT. Here are ten actions to take:

- Understand that crises are a normal part of life and they go through five stages

- Free up your organisation’s cash flow post COVID 19

- Unleashing innovation – to find your non customers, your new services / products in a post COVID world

- Keep your powder dry – contrary to common advice do not act quickly to remove staff as you don’t know enough

- Embrace Peter Drucker’s abandonment to clear the decks for innovative thinking

- Create one page cash-orientated reports (cash in, cash out, new customers, last order form key customers, last visit to key customers, status with revenue generating ideas, KPIs)

- Move to four- and five-week periods so rolling planning and forecasting is more meaningful

- Increase the quality of a key customer’s experience

- Adopt new systems – especially an eCommerce platform as some new products and services will be sold to new markets

- Increase communication by a factor of ten (to staff, your key customers, your use of your mentor)

1. Understand that crises are a normal part of life and they go through five stages

Jack Welch had a large realism streak in his body. He would take the necessary action, face the necessary music and move on. Jack Welch handled each crisis on the following assumptions:

- The crisis will be worse than it first appears

- The bad news will come out sometime so may as well face the music now

- The situation will be portrayed in the worst possible light by ‘the press’

- There will be carnage

- The organisation will survive.

What is so important about the five stages is that it encourages one to face the music sooner and know that at the end, the organisation will survive.

The leader of your organisation would do well to read these comments:

- “The ultimate measure of a leader is not where the leader stands in moments of comfort and convenience, but where the leader stands in times of challenge and controversy”. Dr Martin Luther King

- “Leadership is a Foul Weather Job” Peter Drucker

- “I can say with conviction and confidence that a crisis is when it gets fun for talented and imaginative leaders.” Tom Peters.

Action: read Jack & Suzy Welch’s book Winning and put the five stages on the wall in every office.

2. Free up your organisation’s cash flow post COVID 19

I have developed a cash flow rule, called the rule of 13. You can only rest when your organisation can pay the next 13 weeks (91 days) of liabilities with no cash coming in during that period. This cash fighting fund needs to be built up immediately.There is a huge amount of work you can do including:

- Reducing the cash tied-up in working capital

- Buy quality used rather than new equipment

- Reduce utility costs

- Reduce rent negotiating, subletting to organisations who are free to downsize their accommodation)

- Chase-up on all long term debt

- Cut pay by larger percentages as the pay bands rise. E.g. like the tax authorities who charge more tax on higher pay bands.

- Renegotiate advertising costs and re-prioritise rather than radically reduce.

- Re-negotiate your borrowing now especially any loans that are due for repayment in the next nine months

- The setting up of new debtor collection rules

Cut pay by larger percentages as the pay bands rise

In the post COVID recovery there will need to be a flattening of the salary gaps as the skills and experience of the highest paid senior management that were once highly sought after and paid accordingly may not apply in the trading conditions the organisation faces.

In the new world the endless meetings and the column of reports prepared each month will be abandoned by any organisation that wants to survive. There isn’t a whole raft of customer’s begging for your services. Staff with entrepreneurial skills will now come to the foreground and they may be in the ranks of the lower paid employees.

Sir Bob Horton, in downsizing BP’s head office sold Britannic House in 1991, and layers of management were made redundant when it was discovered that all they did was attend meetings in very expensive places around the world. BP’s results did not miss a heartbeat with the downsizing.

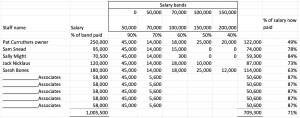

In Exhibit 1, I suggest you use the following logic when setting the salary cut bands.

0-55,000 = Employees will get 90% of their salary

50,000-70,000 = Employees get 70% of the amount they are due in this band

70,000-100,000 = Employees get 60% of the amount they are due in this band, and so on

The percentages and bands can be amended. The key is that nobody should be below the living wage. If they are with a 10% cut give them a 10% pay rise as you should have done this earlier.

You can, once the cash flow returns positive, pay back the severe cuts on the highest paid employees so that no one ends up with a cut greater than say 20% in the end.

After this you then can set up a 21st century bonus scheme that I have covered in another paper.

Exhibit 1: Case study of a firm with the owner, who pays themselves $250,000 and nine staff.

In this example the portion of all salaries over $200,000 are forfeited. Between 150,000-200,000 only 40% is paid. The Excel calculator is part of the e-templates accompanying the working guide “Free up your organisation’s cash flow – post COVID 19”.

The setting up of new debtor collection rules

You can no longer survive if you are leaving the chasing up of debt to the least paid workers in the organisation and paying sales staff based on billed not collected revenue. Anybody can sell to a client who has no intention of paying.

In the past collecting debt was very unfashionable. That is why it was left to poorly paid accounts receivable clerks.

- Sales over $__k are now to be followed by a phone call, “Is everything okay with regards the invoice?” to avoid a lag if there is a problem.

- Five days late with payment triggers first collection call

- Fortnightly calls after that point

- Date set for stopping future sales if an invoice is still unpaid

- Have agreed escalation rules

- > 30 days >___K, Finance Manager calls the customer’s Finance Manager

- > 60 days >___K, Finance director calls the customer’s Finance director

- > 90 days >___K, CEO calls the customer’s CEO

Once you have done these changes there are a number of poor business practices that need tackling because they affect cash flow

- Negotiating the wrong deals

- Offering discounts without any awareness of other discounts being offered (After giving a customer an order size discount, payment terms discount, annual volume bonus and a special promotions discount you may well find all gross profit has gone)

- Paying staff monthly – moving fortnightly pay has many advantages, smooths out cashflow, fits with a four- and five-week months which leading organisations use, better for forecasting.

- Pursuit of growth at all costs – re-read Warren Buffet’s quote.

- Over reliance on one major customer

All of these points are discussed in detail in my cashflow working guide.

Action: purchase David Parmenter’s working guide on “Free up your organisation’s cash flow – post COVID 19”

3. Unleashing innovation – to find your non customers, your new services / products in a post COVID world

There is a systematic way to do this and “use every brain in the game” (e.g. all your staff) to come up with ways to replace lost revenue by using the Blue Oceans Shift methodology and to make the operations more efficient by embrace Gemba Kaizen. I have written about it in a working guide (77 pages, about a two-hour read). It would be remarkedly stupid to have a massive downsizing before such an exercise.

My paper on the topic covers the following:

- Barriers to Innovation

- How the Default Future Drives Us

- A Perfect Storm

- Implementing Gemba Kaizen Innovation

- Challenge the Old

- Just Do It

- Use the Wisdom of The Crowd and Research Problems Deeply

- Never Stop Once Started

- The Four Foundation Stones for Kaizen

- Waste (Muda) Elimination

- Housekeeping

- Visual Management

- Adopting Time Saving Techniques

- Implementing a Blue Ocean Shift (BOS) Innovation

- Step 1: Get started.

- Step 2: Understand Where You Are Now (By Drawing A Strategy Canvas)

- Step 3: Imagine Where You Could Be

- Step 4: Find How You Get There

- Step 5: How to choose and Make the Blue Ocean Move

- Selling and Leading Change

- Why You Need to Undermine The Default Future

- Importance of Self Persuasion

- John Kotter’s Leading Change

- Selling A BOS Project to the Executive

- Innovation Advice from The Great Management Thinkers

Templates

- BOS Project Team Checklists and Questionnaires

- Job Description for the BOS Team Leader

- Workshop Preparation Checklist

- Guidelines to Running Workshops

Action: purchase David Parmenter’s working guide on “Unleashing innovation in your organisation“

4. Keep your powder dry – contrary to common advice do not act quickly to remove staff as you don’t know enough

Contrary to common advice do not act quickly to remove staff as you probably don’t know enough at the moment. The companies that emerged from the 2007-08 crisis in the strongest shape relied less on layoffs to cut costs and leaned more on operational improvements. That’s because layoffs aren’t just harmful to workers; they’re costly for companies with a whole raft of costs including:

- redundancy payments

- the holt in operations as everyone is scrambling to reapply for their jobs

- the cost of the internal interviewing process both in downsizing and upsizing

- the recruitment cost when upsizing

- the unproductive time as new staff settle in

- the training costs of new staff.

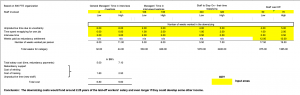

By my calculations (see Exhibit 2), an organization with 500 full – time employees that is contemplating dismissing between 50 and 70 staff members would be no worse off if the staff members were kept on and redeployed, where possible, for up to 2-2.5 years.

In other words, if the turnaround is going to be within this period you would be a mug to downsize.

If the staff can tap into their unexploited entrepreneurial potential they might be able to find new revenue streams to help cover some of their salary costs and thus the breakeven could stretch to three years. A period longer than the last two recessions mentioned.

EXHIBIT 2 Hidden Costs of Dismissing Staff

Honeywell case study

After the stock market crash in 2000, Honeywell laid off nearly 20% of its workforce and then struggled to recover in the downturn that followed. So when the Great Recession hit, in 2008, the company took a different approach, as Sandra J. Sucher and Shalene Gupta describe in their 2018 HBR article, Honeywell furloughed employees for one to five weeks, providing unpaid or partially compensated leaves, depending on local labour regulations. That saved an estimated 20,000 jobs. Honeywell emerged from the Great Recession in better shape than it did the 2000 recession in terms of sales, net income, and cash flow, despite the fact that the 2008 downturn was much more severe.

Action: set-up a cross-team exercise right across the company to think of new ways we can do things and potential unexploited revenue opportunities using the Blue Ocean Shift methodology. Purchase David Parmenter’s working guide on “Unleashing innovation in your organisation“

5.Embrace Peter Drucker abandonment to clear the decks for innovative thinking

I consider abandonment as one of the most important gifts bestowed on us by Peter Drucker. It is unusual that such a profound concept should have been left unnourished by so many writers who followed in his footsteps. Amongst the overgrown and chaotic jumble within an organisation Drucker saw a clear pathway to freedom, innovation and productivity through the adoption of regular and systematic abandonment. Drucker knew more than anyone, that human beings never like to admit a mistake or own up to failure. To avoid facing the truth we hope circumstances will somehow conspire to justify the daft decision in the first place.

Drucker said: “The first step in a growth policy is not to decide where and how to grow. It is to decide what to abandon. In order to grow, a business must have a systematic policy to get rid of the outgrown, the obsolete, and the unproductive.”

He also said: “Don’t tell me what you’re doing, tell me what you’ve stopped doing.”

He saw abandonment as fundamental as breathing, a natural passing of old to new. Examples of abandonment you should look for include:

- Cash cows of the past (which were no longer generating the income to justify their continued existence)

- Rectifying recruitment mistakes (no matter how good your recruitment process is, you will make mistakes and these staff need to moved on)

- Unsuccessful projects

- The report writing machine – instead of reports insist on short presentations followed by implementation cross-functional workshops so less time spent naval gazing and more time doing.

- Systems that are not delivering

- Processes that we have maintained only because we did it last month, last quarter, last year.

- Meetings that we attended that do not change anything

You need to measure the extent of abandonment across the organisation. Read more about Peter Drucker’s advice on Performance Management and Innovation

Action: Establish an abandonment day, every month, yes every month and get all teams to table at least one abandonment and the rest of the organisation has 24 hours to argue why it should not go.

6. Create one page cash-orientated reports

You need to create an eye catching one pager that is on the CEO’s desk every morning. Why not call it “The nine o’clock news” as one organisation has done. The key post COVID 19 numbers I would want to see are:

- cash in, cash out, daily

- new customers weekly

- last order from a list of all key customers (category 1), weekly

- last visit to key customers, from a list of all key customers, weekly

- status with new revenue generating ideas, weekly

- KPIs 24/7,daily, weekly according to their importance

- Queries / complaints from key customers that have not been resolved within four hours

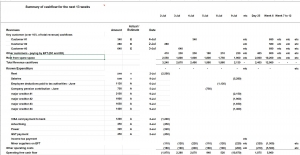

You cashflow statement could look like Exhibit 3.

Exhibit 3: A Post COVID cashflow.

I have discussed these key points in many articles.

Action: Use this cashflow e-template by purchasing David Parmenter’s working guide on “Free up your organisation’s cash flow – post COVID 19”.

7. Move to four- and five-week periods so rolling planning and forecasting is more meaningful

Julius Caesar gave us the calendar we use today. It is a major hindrance to forecasting. With the weekdays and number of weekend days, in any given month, being different to the next month it is no wonder forecasting and reporting is unnecessarily compromised. In some companies February is charged with one twelfth of annual salary, annual rent etc. No wonder February always shows a poor result as revenues are gathered in 20 working days compared to 23 in some other months.

Forecasting models should be designed with months that consist of four or five weeks e.g. based on a “4, 4, 5 quarter”; that is, two four-week months and one five-week month are in each quarter, regardless of whether the monthly reporting has moved over to this regime. Calculating and forecasting the following items then becomes easier:

- For retail, you either have four or five complete weekends (the high revenue days).

- You either have four weeks of salary or five weeks of salary and naturally fits with fortnightly pay that has been recommended.

- Power, telecommunications and property related costs. These can be automated and be much more accurate than a monthly allocation.

- Improved comparisons. Precise four or five-week months make comparisons more meaningful

- Less impact on the working week. The financial systems are rolled over at the weekend

- Month-end reporting is much more efficient. You now close on the same day every period

How Rolling forecasting would be modified

In my rolling forecasting toolkit, I talk about forecasting quarterly, six quarters ahead. In a post COVID 10 world we will be forecasting fortnightly for around nine months and then back to quarterly updates.

The Post COVID forecasting (PCF) process is where teams sets out their revenue and expenditure for the next two financial quarters every fortnight. This means before approving these estimates, management sees the bigger picture out two financial quarters.

Budget holders are encouraged to spend half the time on getting the details of the next six weeks right, as these will become targets, on agreement, and the rest of the time on the remaining weeks of the two quarters. See Exhibit 4.

Each forecast is never a cold start as budget holders have reviewed the two quarters several times already. With the appropriate forecasting software, management can do their forecasts very quickly. I would recommend a virtual lock up, say the Thursday before the next fortnight starts.

Exhibit 4: revenue and expenditure forecasting in a post COVID 19 recovery

The forecasting update will be done fortnightly in a robust system and not in Excel.

Spreadsheets have no place in forecasting, budgeting and many other core financial routines. Spreadsheets were not designed for many of the tasks they are currently used to accomplish. In fact, I often remark in jest at workshops that many people, if they worked at NASA, would try to use Microsoft Excel for the US space program, and many would believe that it would be appropriate to do so.

A spreadsheet is a great tool for creating static graphs for a report or designing and testing a reporting template. It is not and never should have been a building block for your company’s planning systems. The high level of errors in spreadsheets is the main reason why. A major accounting firm pointed out that there is a 90 percent chance of a logic error for every 150 rows in an Excel workbook.

Rule of 100

I believe you can build a forecasting model in a spreadsheet application and can keep it within 100 rows without much risk. Pass this threshold and you expose yourself and the organization.

I have discussed how you implement a rolling forecasting system in a planning tool in a toolkit available on my website.

Action: purchase David Parmenter’s toolkit “How to Implement Quarterly Rolling Forecasting and Quarterly Rolling Planning – and get it right first time (Whitepaper + e-templates)”

Action: purchase David Parmenter’s toolkit “How to Implement Quarterly Rolling Forecasting and Quarterly Rolling Planning – and get it right first time // Toolkit (Whitepaper + e-templates)”

8. Increase the quality of a key customer’s experience

During a recession it is common to cut down travel, reduce staff numbers, remove peripheral services. These changes, if they impact your Key customers’ experience, will get you into trouble. Now is the time to double down, go the extra mile.

So the first thing to do is to sort out your customers into groups.

I suggest you group your customers into five groups

- Your key customers defined by loyalty, profitability, respect, friendship. These customers are often your fans. They would be delighted to recommend you on but, you have been too busy in the past to ask. Is that right? Also, because of the level of trust that exists between you they will be interested in trialling new products/service you have developed utilising your spare capacity and the Blue Ocean Shift (BOS) methodology. In fact, your key customers are often used in the BOS process to provide ideas for new products/ services. You need to maintain or increase connection so your organisation would be the last supplier they would drop.

- Large customers where there is no love, typically multinationals. They may offer you a large contract one day and turn the tap off without a phone call or letter the next day.

- Your up and coming customers where the signs are that they are growing and they like your services. You should maintain or increase services levels and certainly ask for referrals.

- Your other customers who are reliable payers.

- Your customers who are unreliable, changing orders at the last minute, wanting uneconomic quantities, wanting post COVID 19 discounts and in the end cost you more than you make.

Action: Have a love-in with category one customers. You may even get more custom and also find innovative ideas from them to meet their other needs. Get rid of category 5 customers. Even point them to your opposition as they deserve each other. By the way you should have done this years ago.

9. Adopt new systems – especially an eCommerce platform

Now is the time to look at new technology:

- You now have the time to focus on it

- You need the cost savings it will create

- It can open new markets abroad to customers you will never meet

In your organisation you have gathered much intellectual property. Now may be the time to commercialise it. Especially to your noncustomers in countries that your current footprint does not cover and who may not have the resources to pay for face to face consultations anyway.

In the past you may have been writing whitepapers, delivering webinars and giving them away. Turn them into toolkits (long whitepapers with attached electronic media) and revenue generation webinars. This is a small by reliable an untapped revenue source.

Action: Ask all employees for three systems the organisation should be using or using better and three pieces of intellectual property that could be sold remotely with out damaging other revenue streams. Correlate the responses and select the top three and act now.

10. Increase communication by a factor of ten

John Kotter said that when selling change you will under communicate by a factor of ten. He outlined eight stages you need to do well to lock in the change. These are discussed in detail in my working guide on selling change.

Here are some suggestions for increased communication:

- As soon as you can you need hold staff meetings to discuss:

- The new cashflow rules

- Their concerns – as you need to avoid the cancer that uncertainty feeds

- Feedback on progress (at least twice a week)

- Good news whenever you get it e.g. large new customer

- Organise meetings with your key customers (category 1 as previous defined) to cover:

- What additional things can we do to add value to you?

- Who do they know that could benefit from our services and would they organise an introduction?

- What services / products are you seeking but at present are finding difficult to source?

- More frequent meetings with your mentors to discuss:

- you next moves before you undertake them

- noncustomers you have missed considering in the past

- other businesses we could be collaborating with

- gain guidance on the messages you may have forgotten to cover

- proposed layoffs

- If layoffs are to occur then don’t hold back – be honest and seek advice on the best action to take. Use every brain in the game.