Your cart is currently empty!

One fact staring us in the face is that AI will automate many tasks that the finance team currently performs, and at the same time, render many aspects of their business redundant or impact them by new players.

Finance teams and their organisation need to adapt, NOW. How do you do this? By removing all the antiquated processes the finance team has thrived on, to its detriment. Thus, creating time to embrace innovation.

I wrote about this in the article ‘Ready or Not?’ published in ICAEW’s Finance & Management, November 2014

Every high-performing finance team must be focused on helping their organisation get future-ready. By future ready, we mean an organisation that is fast and light on its feet, able to react quickly to events as they unfold, an organisation that is nimble through utilising world best practice, an organisation that is an advanced adopter of leading edge technologies, an organisation with modern people practices that abandon the broken, ill-conceived management practices of the past.

The issue, however, is that many finance teams are far from future-ready. In truth, how many finance teams are satisfied that they have:

- fully embraced all the lean best practices to be future-ready?

- An annual planning process that helps their organisation get future-ready?; and/or

- successfully adopted the tried and tested leading edge technologies now available in the21st century?

THE BURNING PLATFORM

But while there are some finance teams that are most definitely future ready, a majority are stuck in a time warp, blissfully ignoring the change around us that signals the future. This article will look at areas the finance team can focus on to get some rubber on the road in this important, maybe, organisation-saving area. I am talking about key performance indicators (KPIs), the annual planning process, forecasting, using outdated technology and, to round it off, period-end reporting.

These processes have failed to stop the drift of once-great companies such as BlackBerry, Kodak and Polaroid. Their busy executives were no doubt, like Nero, busy fiddling while Rome was burning. Attending another annual planning round where management and the board were told the lies they wanted to hear. Taking home a briefcase full of reports that on their third return journey were deemed as read.

What role did the finance team play in these failures? Were they not heard or did they not make the message clear?

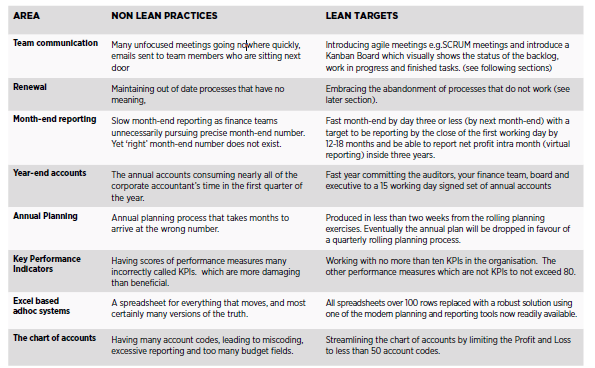

1. EMBRACING THE LEAN

The finance team needs to create time for change, to have more time to act. To create this magic we need time. Where do we find this time? We find it by attacking the top 20 mistakes corporate accountants make. An extract from my related whitepaper is shown in the table below:

You can read about the solutions in the article and purchase my Lean 21st Century Finance Team Implementation Guides, which will prepare you and your team for the future.

You can read about the solutions in the article and purchase my Lean 21st Century Finance Team Implementation Guides which will prepare you and your team for the future.