Your cart is currently empty!

One fact staring us in the face is that AI will automate many tasks currently performed by the finance team, and at the same time, render many aspects of their business redundant or impact them by new players.

Finance teams and their organisation need to adapt, NOW. How do you do this? By moving to rolling planning and forecasting in a planning tool.

I wrote about this in the article ‘THE ADVANTAGES OF ROLLING FORECASTS‘ published in ICAEW’s Finance & Management, March 2015

In the article I wrote:

Annual planning is an anti-lean process in need of some radical surgery

Annual planning, as businesses use it today, is one of the greatest mistakes organisations have made since 1494, the year Pacioli wrote about double-entry bookkeeping in Summa de arithmetica, geometria, proportioni et proportionalità. The first writers to put annual planning to the sword were Jeremy Hope and Robin Fraser in their classic book ‘Beyond Budgeting’. The reasons why the annual planning process should be replaced is that it:

- takes too long and costs too much;

- leads to dysfunctional behaviour, building silos and barriers to success;

- undermines monthly reporting (monthly budgets are poor targets);

- is not designed for a dynamic company in a rapidly changing environment; and

- is an ‘anti-lean’ process.

Smart organisations no longer have an annual planning process. Instead, they use a quarterly planning process, which I refer to as quarterly rolling planning.

The quarterly planning process

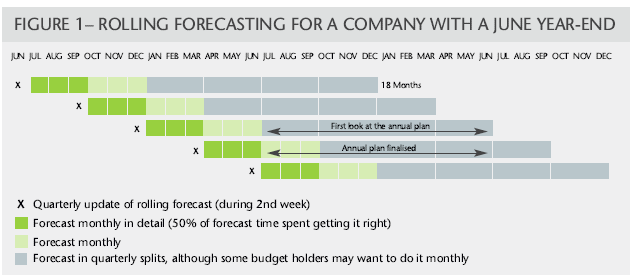

In a quarterly forecasting process, management determines the likely revenue and expenditures for the next 18 months. The focus is on what is happening in the forthcoming quarter, but with an eye to the bigger picture six quarters out. The quarterly forecast updates the annual forecast and provides a view of the next financial year. Each quarter’s forecast is never a cold start, as management has reviewed the forthcoming quarter multiple times. Provided you have appropriate forecasting software, management can do its forecasts very quickly. The average time spent on the four quarterly forecasts per year is five weeks.

Figure 1 illustrates the quarterly rolling process for a June year-end organisation. The bright green zone is the forecast for the next quarter and the most important part to get right. The light green zone represents the second quarter, which is forecasted monthly, and this should be reasonably accurate. Budget holders will be reforecasting this period next quarter.

The teal-shaded zone is only forecast in quarterly breaks, and budget holders are told not to spend too much time second-guessing these quarters. As a guide, budget holders should allocate 60% of their time to the first quarter, as first-quarter numbers will become targets, 20% to the second quarter, and 20% to the remaining four quarters.

You can read about what you need to abandon, how to do a forecast in a week, bottom-up, and why you should move to a quarter-by-quarter funding mechanism in the article. My Lean 21st Century Finance Team Implementation Guides will prepare you and your team for the future.