Your cart is currently empty!

Area of Mastery – Finance Team Best Practice

Building a High-Performing Finance Team

A look inside the book – a 25 page extract

Chief Financial Officers around the world are seeking ways where they can be a better leader and business partner. They are seeking to learn from their peers better practices—and become more effective, creating a positive footprint in every organization they are part of.

Imagine your Finance team making history rather than just reporting on it. Imagine your month-end reporting being completed within 3 working days or less, your annual planning process being replaced by quarterly rolling planning, a year-end when you have the end of audit party within 3 weeks of your year-end, a happy and well function team. This website will offer you methodologies to fix the common problems in the finance team that will have a profound impact on your organisation and on your career.

Author and performance management leader David Parmenter has determined what makes winning CFOs and winning finance teams. His methodology is based around self implementation and has received wide acclaim around the world. He has written a series of toolkits (extensive whitepapers 70 to 100 pages+ electronic templates) that help solve many issues.

See below for a selection of snippets from these toolkits.

- 15 Steps to a Faster, Better Close

- 10 one page reports that Finance teams need to use

- Nine Lessons When Implementing a Quarterly Rolling Forecast on a Planning Tool

- Quarterly Rolling Forecasting – the 14 foundation stones

- The ten things wrong with board reporting packs

- The 10 rules for reporting a finance team need to follow

- 10 strategies for optimizing your accounts payable

LEARN MORE

Are your month-ends one drama after another . Is your organisation succeeding in spite of the annual planning process rather than because of it? Is the finance team a collection of individuals rather than a cohesive team? Is the year-end a process that carries on months into the new year? Does the finance team have a history of late and/ or failed projects? Do you have too many KPIs, many of which are leading to dysfunctional behavior? Are the accountants spending too much time reporting history rather than making it?

If so read these articles and chapter extracts.

| Getting future ready |

Modern methods to adopt |

| Selling change / leadership in Finance |

Example of exhibits that can be purchase as E-templates

Mastering the traits of a winning CFO

Never before has the role of the CFO been more complex, multi-faceted and rewarding. The CFO is now juggling more balls in the air than ever before, in front of an audience that is more demanding and knowledgeable.

What makes the difference from average to good and from good to great performance?

In this article I will attempt to shed some light on why you may not be scoring the goals you should, save training drills and suggestions. Please note that I am not writing this from personal success. I have never been a CFO, nor was I a good corporate accountant. I am basing this article on countless years of benchmarking CFO’s from all sectors and whose success varied from poor to great.

The CFO is now juggling more balls in the air than ever before, in front of an audience that is more demanding and knowledgeable. What makes the difference from average to good and from good to great CFO performance? I believe I have the answer. The model I have developed is based on countless years of bench marking CFO’s from all sectors and whose success varied from poor to great.

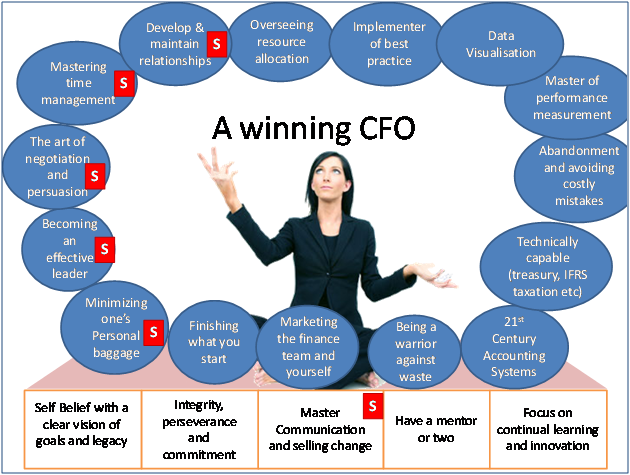

Once the foundation stones in place, you can now use them as a platform from which to juggle the areas of focus, see Exhibit 1, that make up being a winning CFO. Many of the focus areas have a soft skills component, an area which is often not on the CFOs radar screen. These have been marked with an ‘S’.

To continue reading please view Mastering the traits of a winning CFO .

David Parmenter can help in 3 ways:

1. David Parmenter’s implementation guides with E-templates

If you want to access the latest thoughts of David Parmenter on implementing quarterly rolling forecasting, a planning tool, KPIs, annual planning, buy his implementation guides which are constantly updated and are comprehensive (100- 120 pages). All these guides come with electronic templates to get your implementation started. At the time of acquisition, David reviews, updates the guide as appropriate, and emails them to the purchaser.

3. E-templates from David Parmenter’s best-selling finance book The Financial Controller and CFO’s Toolkit

You can purchase all the electronic versions of the book templates. Once the paypal notification has been received the templates are emailed with 48 hours.

2. David Parmenter’s ‘Expert’ articles

For areas which are not covered by an implementation guide, David Parmenter has written a shorter (20- 30 pages) ‘Expert’ Article to help you make progress. They can be read and absorbed in an hour. All you need to do is purchase them via the PayPal link and they will be emailed to you with accompanying useful E-templates within 48 hours. To buy multiple guides access the special deal.

Short Interview With David Parmenter

Dear David,

I bought this book in an attempt to learn more about lean practices and various finance frameworks and I was not disappointed. This is by far one of the best books on the subject on Amazon. Every concept is explained with examples so that you can directly apply it to your organizations.

Florian G

Additionally, the concepts in the book are not super basic like in some others. There is a good combination of concepts levels. I recommend whether you are new to the Finance industry or an experienced professional already.