Your cart is currently empty!

Area of Mastery – Quarterly Rolling Forecasting and Planning

How to Implement Quarterly Rolling Forecasting and Quarterly Rolling Planning – and get it right first time – Implementation Guide (110 page PDF whitepaper + E-templates)

If your forecasting is a nightmare, of long nights, Excel spreadsheet error messages and praying that the resulting numbers are right you need to read this paper. This white paper sets out the foundation stones of a rolling forecast process and how to move from annual planning to a quarterly rolling planning process. The secrets of rolling planning are revealed at last. In addition to the white paper you get a comprehensive tool-kit for a fast start including checklists, selling the change presentation, and workshop materials. Find out more about the Implementation guides (white paper and electronic media)

Re-forecasting the year-end position every month is flawed on a number of counts, it never looks further than year-end, each month the forecast changes creating number noise, the opportunity to set realistic reporting targets for the on-coming quarter is not taken up, the forecast model frequently is based in error prone Excel, and seldom do budget holders buy-in to the forecast as they were not involved in the numbers.

Learn more

| Selling QRF: |

| Implementation |

| Why annual planning is broken |

Replacing spreadsheets with a planning tool |

What is a rolling forecast? What is a rolling plan?

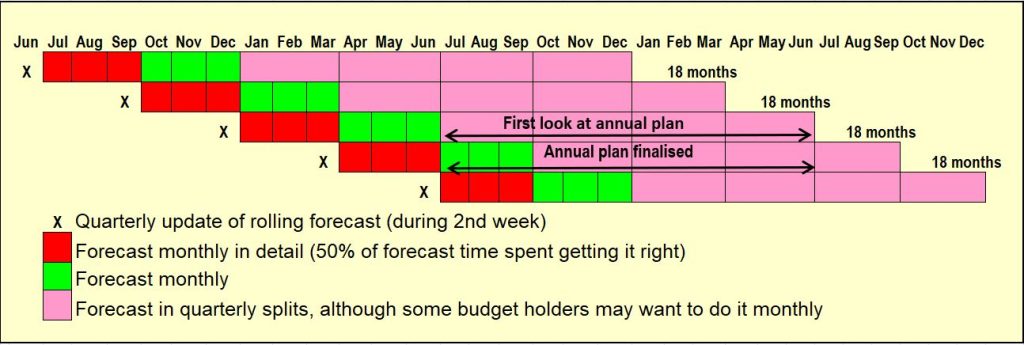

The better practice for rolling forecasting is to perform it bottom up using a quarterly process looking out between 6 – 8 quarters ahead. The quarterly forecasting process is where management sets out the likely revenue and expenditure for the next 18 months. Each quarter, before approving these estimates, management sees the bigger picture six quarters out. All subsequent forecasts while firming up the short-term numbers for the next three months also update the annual forecast. Budget holders are encouraged to spend half the time on getting the detail of the next three months right, the red zone as shown in exhibit 1, as these will become targets, on agreement. The balance of the time then to be spent forecasting the remaining next five quarters.

Each quarter forecast is never a cold start as they have reviewed the forthcoming quarter a number of times. Provided you have appropriate forecasting software, management can do their forecasts very quickly; one airline even does this in three days!! The overall time spent in the four quarterly forecasts during a given year is five weeks.

Most organisations can use the cycle set out below if their year-end falls on a calendar quarter end. Some organisations may wish to stagger the cycle say May, August, November, and February. I will now explain how each forecast works using a June year-end organisation.

How should my finance team be performing?

Imagine your Finance team making history rather than just reporting on it. Imagine your month-end reporting being completed within 3 working days or less, your annual planning process being replaced by quarterly rolling planning, a year-end when you have the end of audit party within 3 weeks of your year-end, a happy and well function team. This website will offer you methodologies to fix the common problems in the finance team that will have a profound impact on your organisation and on your career.

We can make this a reality. I’m David Parmenter. I am the author of The Financial Controllers and CFO’s Toolkit 3rd Edition. It is a follow-on from Winning CFOs and Pareto’s 80/20 for Corporate Accountants.

A look inside the book – a 25 page extract

Download the chapter 14 on “Attracting and recruiting talent”

Download the chapter 3 on “Rapid month-end reporting: by day three or less”

Download the chapter 16 on Implementing quarterly rolling forecasting and planning

Testimonials on The Financial Controllers and CFO’s Toolkit 3rd edition

Eight of the top twenty mistakes a finance team make are connected to planning and forecasting

- Allowing month-end reporting to go past three working days

- Taking months doing an annual plan – when it can be done in 10 working days

- Letting Excel dominate the finance system

- Not investing enough in accounts payable.

- Not adopting the purchasing card (a free, accounts payable system)

- Investing in a complex G/L and then upgrading it too frequently

- Having over 80 account codes for the P/L

- Budgeting at account code level

- Breaking down the annual plan into twelve before the year starts

- Giving budget holders an annual funding entitlement

- Only forecasting to year-end

- Not producing daily/ weekly decision based reports

- Producing numbing monthly financial reports

- Reporting on the wrong performance measures which can damage performance

- Selling change by logic instead of the emotional drivers of the buyer

- Using Julius Caesar’s calendar instead of 4,4,5-week months

- Spending months on the annual accounts

- Working hard but not smart

- Holding onto time wasting habits

- Not investing enough time to attract and recruit talented staff

The fixes are covered in The Financial Controllers and CFO’s Toolkit 3 rd Edition

David Parmenter can help in 3 ways:

1. David Parmenter’s implementation guides with E-templates

If you want to access the latest thoughts of David Parmenter on implementing Quarterly Rolling Forecasting, buy his implementation guide which is constantly updated and is a comprehensive (120 pages) guide. If you want to implement a planning tool, buy his implementation guide(110 pages). Both of these guides come with electronic templates to get your implementation started. At the time of acquisition, David reviews, updates the guide as appropriate, and emails them to the purchaser.

3. E-templates from David Parmenter’s best-selling The Financial Controller and CFO’s Toolkit Book

You can purchase all the electronic versions of the book templates. Once the paypal notification has been received the templates are emailed with 48 hours.

2. David Parmenter’s ‘Expert’ articles

For areas which are not covered by an implementation guide, David Parmenter has written a shorter (20- 30 pages) ‘Expert’ Article to help you make progress. They can be read and absorbed in an hour. All you need to do is purchase them via the PayPal link and they will be emailed to you with accompanying useful E-templates within 48 hours. To buy multiple guides access the special deal.

Other research materials

The ten reasons why you should stop annual planning

- Takes too long, costs too much – too much detail and too many iterations.

- Does not help run the business as it is out of date as soon as the ink has dried

- Leads to dysfunctional behaviour, building silos and gaming the system

- Undermines monthly reporting (monthly budgets are poor targets)

- Is an anti-lean process

- Often has allocations that budget holders have no control over

- Decisions made too early and often too high up

- Prevents value adding activities that were not in the budget

- A bad yardstick for evaluating performance

- Based on planning and central control which has MacGregor’s theory X as its base – that you cannot trust people

Smart organizations do not have an annual planning process anymore. Instead, they use quarterly rolling planning.

Forecasting & Planning Papers

IBM have commissioned me to write two papers which are available on their website for free.

Ballance Case Study

Short Interview With David Parmenter

Dear David,

I wanted to write and say thank you for the positive impact you have had on my own financial career and journey. I first came across your work at a CIMA workshop on KPIs in the early 2000’s.It was held in London. I think it may have been at the CIMA Institute HQ. I was truly inspired that day not only by the content delivered but the way you delivered it. Since then, I’ve purchased your books, updated editions, etc. and have applied many principles.

Without a doubt, the inspiration and the application of your ideas/concepts have given me success, and that success has allowed me life experiences that I would not have thought possible. I always recommend your books to my peers, finance staff, and those going through graduate programs, etc and enjoy the benefits.

The faster month-end close and post-it session to get there has been a particular favorite of mine. It gets the foundations right for the next stages in a Finance department’s evolution. I’ve thought about writing something like this for many years and showing my gratitude. Today I thought I’d just be kind and get on with saying thanks. All the best.

-David Stuart, Finance DirectorHolker Group